The Cashless Growth Engine

When the COVID-19 cash crunch hit, businesses were sitting on millions in assets but had zero liquidity. We helped BXI pivot from a "Surplus Stock" platform to a legitimate "Alternative Currency" ecosystem.

The "Double Coincidence" Trap

BXI (Barter Exchange of India) came to us with a clear vision: To digitize the age-old practice of barter.

Barter is often seen as archaic—a desperate move for companies trying to dump expiring inventory. But the market reality told a different story. Globally, over 400,000 companies were trading $12 Billion in assets annually.

However, BXI was stuck in the "Surplus Trap." They were positioning themselves as a clearance bin for unwanted goods. The Friction: Trust was low. Matches were rare (finding two people who want exactly what the other has is mathematically hard). And businesses viewed barter as a "last resort," not a strategic tool.

It’s Not About "Leftovers."

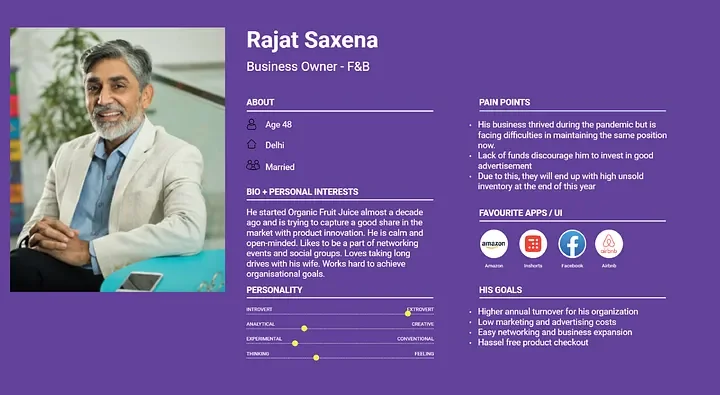

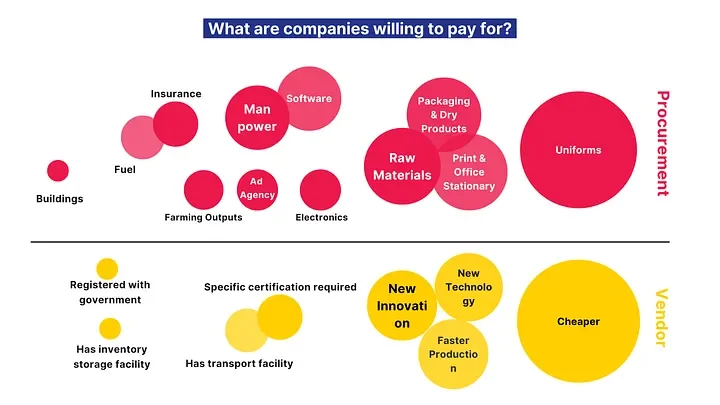

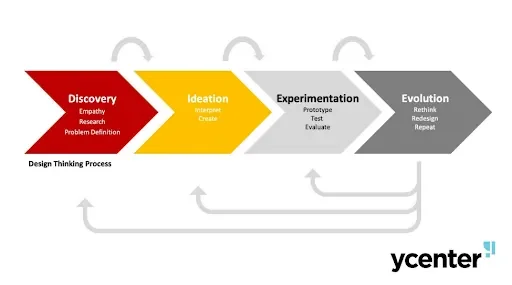

We deployed our ethnographic team to interview business owners across 11 different industries—from media tycoons in Mumbai to real estate developers in Rajasthan speaking the local Hadoti dialect.

The Breakthrough: We realized that BXI’s entire value proposition was wrong. Companies didn't care about "getting rid of junk." They cared about preserving cash.

We found that the barrier wasn't the "quality of goods"—it was the Perception of Power. Barter felt weak. Cash felt strong. To make barter work, we didn't need a better marketplace; we needed to elevate the status of the trade.

A New Economy.

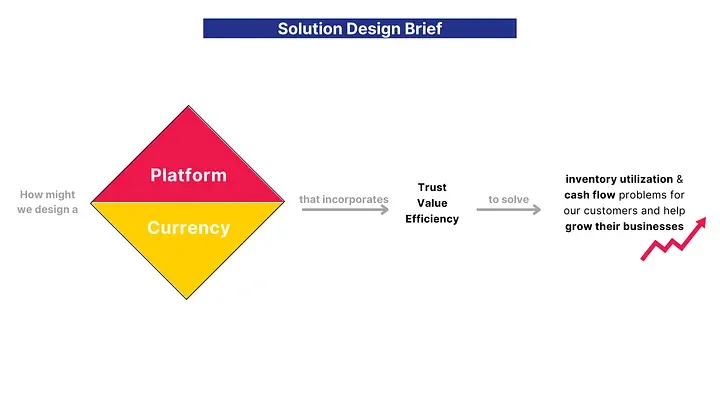

By shifting the lens from "Desperation" to "Strategy," we helped BXI define a new category in the Indian market.

11

Industries Mapped From Media to Real Estate, we codified the exchange rates for diverse asset classes.

Pivot

Business Model Shifted from a "Clearance Bin" model to a "Liquidity Provider" model.

1

Unified Language Standardized the fragmented barter sector into a coherent digital ecosystem.

Standardizing the Trade.

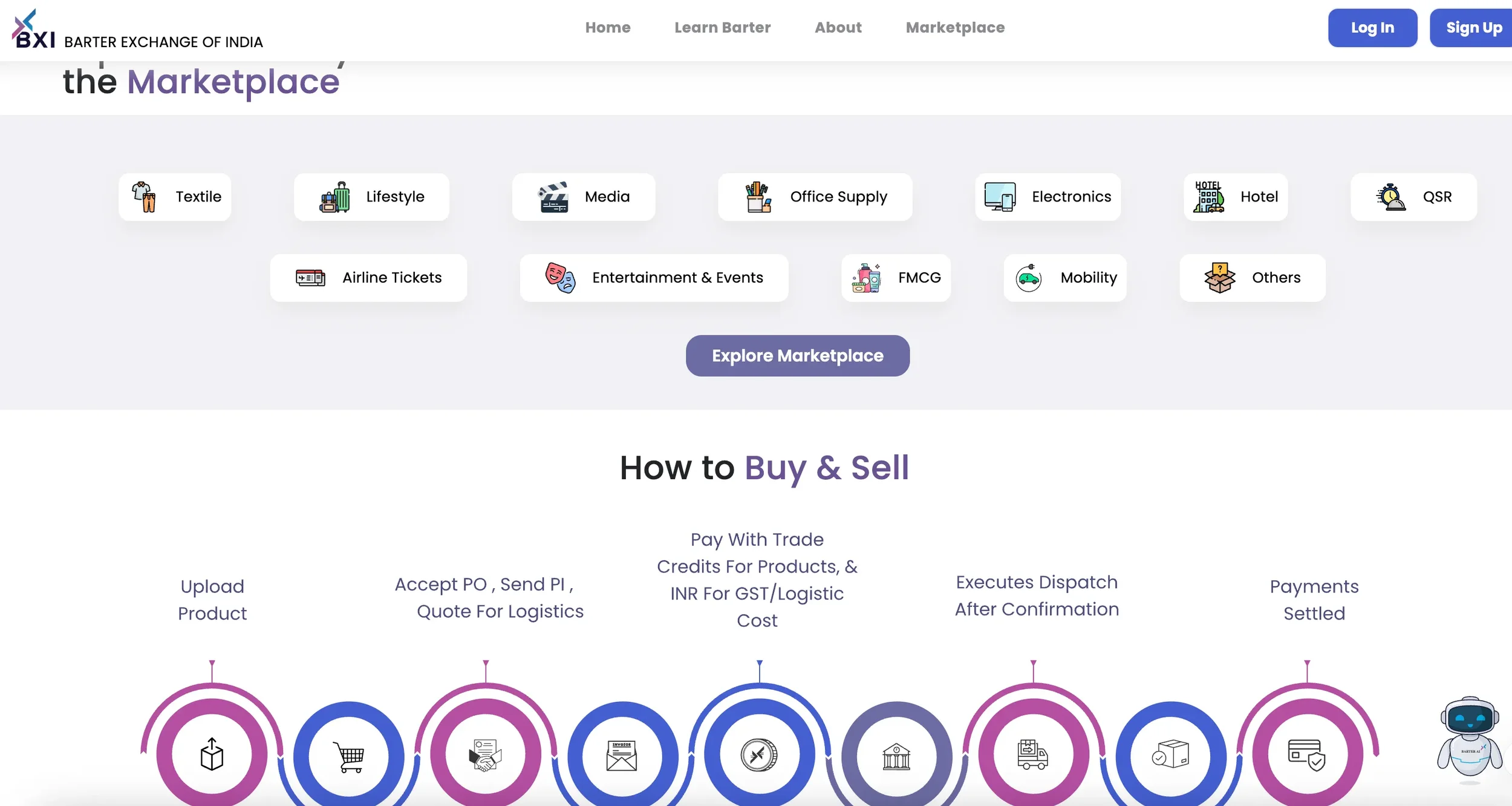

We moved BXI from a "Matching Service" to a "Digital Clearing House."

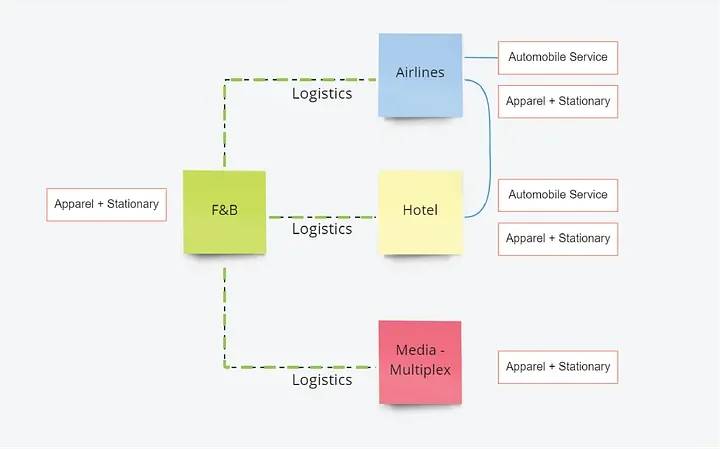

1. The Strategy Shift We stopped selling "Surplus Management" and started selling "Internal Asset Monetization." We showed CFOs that their unused media slots, empty hotel rooms, and idle machinery were actually Liquid Currency.

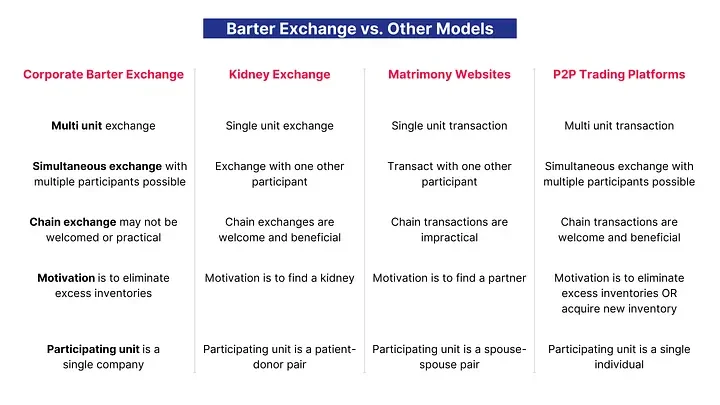

2. The Tech Roadmap We designed a roadmap for a platform that solved the "Double Coincidence of Wants" problem.

Instead of Person A trading directly with Person B, we introduced a Standardized Barter Credit.

You trade your goods into the network, earn credits, and spend them anywhere in the ecosystem.

3. Trust Engineering We built a verification framework into the user journey, ensuring that a "Barter Deal" carried the same contractual weight and professional gloss as a cash deal.